colorado electric vehicle tax rebate

A new federal tax credit of 4000 for used EVs. The bill introduces two credits for new EVs totaling up to 7500 per car.

Electric Vehicles In Centennial City Of Centennial

Receive up to 6000 or 50 cost match for a Level 3 DC Fast Charger and electric service installation data collection capability required.

. Numerous state incentives give Colorado drivers the opportunity to save some green by going green. The Colorado Energy Office CEO administers Charge Ahead Colorado an electric vehicle EV charging infrastructure grant program. Electric vehicle tax credits aims to help low- and middle-income buyers but excludes many vehicles.

A new electric vehicle can qualify for a credit of 3750. A generous tax credit with a big asterisk. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle.

The credits decrease every few years. As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500. 2500 in state tax credits and up to 7500 in federal tax credits.

Colorado electric vehicle tax rebate Wednesday August 10 2022 Edit. Save up to 5500 on an Electric Vehicle EV Income-qualified customers can receive 3000 off a used or 5500 off a new EV when you. Experts say the bills electric vehicle tax credits - up to 7500 for a.

Tax credits are as. Xcel Energy has a new roster of electric vehicle rebates and charging station subsidies for customers including for used vehicles. INCOME-QUALIFIED ELECTRIC VEHICLE REBATE.

Information in this list is updated throughout the year and comprehensively reviewed annually after Colorados legislative session ends. Zero-emission vans SUVs and trucks with MSRPs up to 80000 qualify. Ad Compare Specs Of Our Electric Vehicles Like The Ioniq Or Kona Electric Find Yours Today.

Driver incentives range from those offered by. Receive up to 2500 for truck stop parking. The table below outlines the tax credits for qualifying vehicles.

While Colorado does not have an electric vehicle rebate the state offers tax credits for the purchase or lease of an electric vehicle EV of up to 3500. Light duty electric trucks have a gross. Contact the Colorado Department of Revenue at 3032387378.

Drive Clean Colorado DCC- South Central. The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a decade until the. Why buy an Electric Vehicle.

The bill also includes up to a 4000 tax credit for used electric vehicles which were previously not eligible. Trucks are eligible for a higher incentive. Electric sedans priced up to 55000 MSRP qualify.

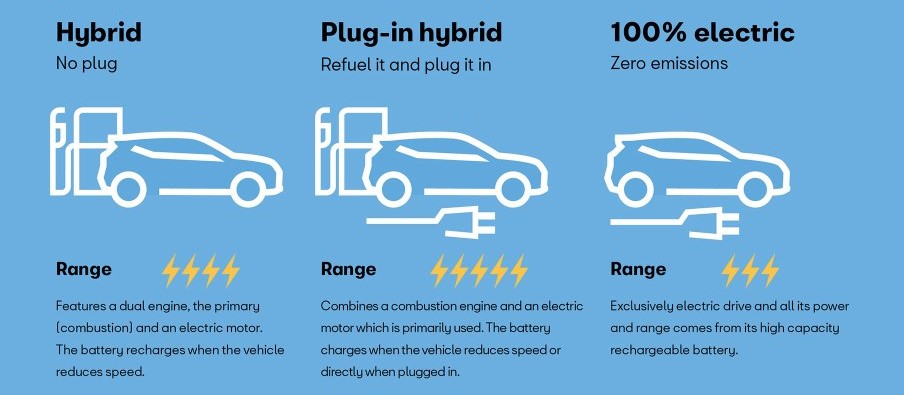

There is also a. Park Chaffee Fremont Custer El Paso Pueblo Elbert. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore How Do Electric Car Tax Credits. Learn about the variety of electric vehicle models and the discounts you can take advantage of from trusted dealerships around Colorado on our EV Deals page. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69.

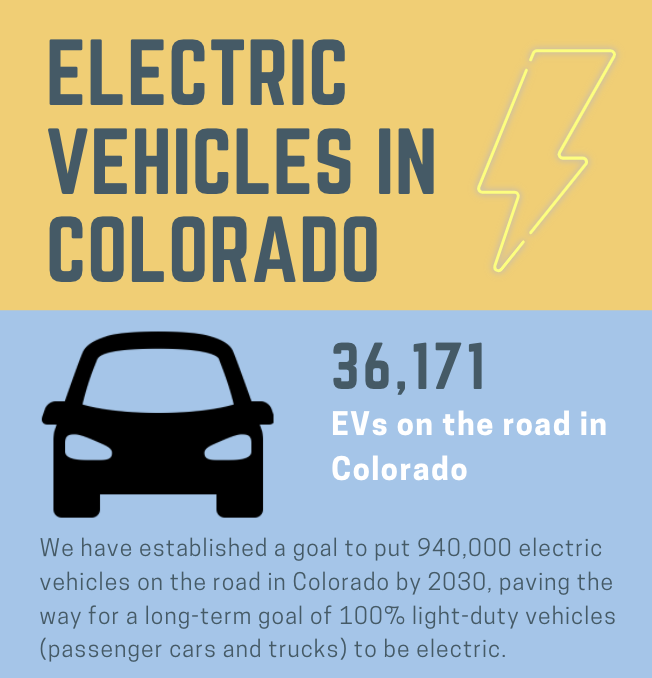

The bill also adds some new restrictions on who can claim the tax. Grants are available for. One of Governor Polis first executive orders Executive Order B 2019 002 Supporting a Transition to Zero Emission Vehicles includes supporting the acceleration of widespread electrification.

The State of Colorado offers an income tax credit for the purchase or lease of an electric motor vehicle a plug-in hybrid motor vehicle or an original equipment manufacturer electricplug-in. Qualified EVs titled and registered in Colorado are eligible for a tax credit. Some dealers offer this at point of sale.

Colorado EV Incentives for Leases. Electric vehicles emit fewer greenhouse gases than gas-powered vehicles. Green Driver State Incentives in Colorado.

The tax credit for most innovative fuel vehicles is set to expire on January 1 2022. Get information about state. EVs in Colorado as of January 1 2022.

Drive Electric Colorado exists to provide you individual consumers with information about electric vehicles in Colorado. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the.

Five Things To Look For In Buying An Electric Vehicle For Below 50k The Hill

How Do Electric Car Tax Credits Work Credit Karma

Are Michigan S Registration Fees On Electric Vehicles Causing It To Fall Behind Other States

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Zero Emission Vehicle Tax Credits Colorado Energy Office

A Complete Guide To The Electric Vehicle Tax Credit

Manchin Bill Tesla Electric Car Tax Credit May Be Limited Bloomberg

All About Electric Vehicles De Co Drive Electric Colorado

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Tax Credits De Co Drive Electric Colorado

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Charging Rebates Electric Vehicle Charging Ev Charger Electricity

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

Tax Credits De Co Drive Electric Colorado

/cloudfront-us-east-2.images.arcpublishing.com/reuters/43L4KKPDZFPS7AEGULKUZGRNT4.jpg)

Ustr Backs Efforts To Strengthen U S Ev Industry Despite Objections Reuters

Electric Vehicles In Colorado Report May 2021

States Used To Help People Buy Electric Cars Now They Punish Them For It Electric Cars Hybrid Car Electric Car Conversion